To find out more about ICAN Thrive’s services please email thrive@ican.org.au or call: 1800 369 878 or use our Thrive web contact form below.

Thrive Contact Form

Contact form for Thrive programs

To find out more about ICAN Thrive’s services please email thrive@ican.org.au or call: 1800 369 878 or use our Thrive web contact form below.

Contact form for Thrive programs

Want to reduce your money going out and increase money coming in? Then follow the Yarnin’ Money (SHORTS – Tips & Tricks) video series, as it explores Tips and Tricks to reduce your spending and increase your income. In this clip, we look at the best time to go market shopping in Cairns. You could try to do the same if you don’t live in Cairns and have a fresh food market in your area. Please subscribe to ICANTV1.

Lotus Glen Correctional Centre (LGCC) has partnered with the Indigenous Consumer Assistance Network (ICAN) to focus on delivering strong financial skills training for prisoners.

The focus of the collaboration is to increase prisoners access to skills such as budgeting and management of finances which are critical skills for everyday living.

These skills bring a value of self-belief and a positive affirmation for the prisoners and the struggle of debt and lack of financial understanding within the prisoner cohort causes stress, angst and a loss of self-confidence.

Service Delivery Support Officer (SDSO) Tania Parker and Indigenous Consumer Assistance Network (ICAN) Financial Counsellor Sharon Edwards got together to look at how a partnership could address these concerns, and assist in providing an opportunity of change for the prisoners by providing tools for the prisoner to feel confident in the management of their personal finances upon transition back into the community.

ICAN CEO, Aaron Davis said the collaboration with LGCC was an opportunity to help prisoners regain financial control of their lives and teach lifelong skills to help them support themselves.

“We are really excited about this opportunity to empower people that have often had very complex and dynamic lives, “ Mr David said.

“We know that debts don’t magically disappear when someone goes to prison and can become one of the greatest barriers to re-integration and rehabilitation.”

“For ICAN, our focus is on breaking down this barrier by providing financial counselling support to manage existing debts and education to promote good financial literacy in their future.”

With the assistance of the SPER Hardship Partners Team from Queensland Treasury, a strong partnership has been formed.

Twenty men have successfully completed their first Yarnin Money workshop, with eighteen continuing on with individual one-on-one financial counselling.

Due to the success of the program, Yarnin Money has now become a LGCC staple program, and ICAN a part of the LGCC community.

Tania Parker SDSO said the response from prisoners about the program had been very positive.

“Our goal is to provide this fantastic opportunity to as many of our prisoner cohort as possible, and we have received very positive feedback about the program,” Ms Parker said.

“All the participants were engaged, they shared ideas and stories, and have spoken to other prisoners about their positive experience within the program, which has generated great interest amongst the prisoners.”

ICAN Financial Counsellor, Sharon Edwards said that interest and uptake of the service has been overwhelming and this is an area of great need.

“There are numerous impediments to the provision of financial counselling in a prison setting, like meeting creditor identification requirements, providing evidence of low income, to just general day-to-day client contact.” Ms Edwards said.

“By working together to identify and remove some of these barriers for prisoners, our partnership has also streamlined access to the Work Development Order Program.”

“Participants now have the ability to reduce their SPER debt through accessing our service in the prison. I believe this is a first for Queensland.”

SPER’s Hardship Partner program gives people in genuine hardship realistic options to resolve their debt. Delivering this program with partner organisations like ICAN has been key to ensuring debtors experiencing hardship have access to such options, including Work and Development Orders. Partnerships like that which Sharon and Tania have established between ICAN and LGCC means prisoners have access to this program and can now work towards getting on top of their debts.

ICAN and service partners the Commonwealth Bank, Centrelink, Good Shepherd Microfinance, Many Rivers, Australian Competition and Consumer Commission (ACCC) and Queensland Office of Fair Trading (OFT) held a Yarnin’ Money Day event on Palm Island, earlier this month. The one-stop-shop, set up at the local TAFE and provided superannuation, wills, banking, No Interest Loans (NILS), small business and consumer regulatory information and support services to over eighty Palm Island residents.

ICAN developed the Yarnin’ Money Day concept as a pro-active response to potential financial issues arising from the $30 M Palm Island Class Action Settlement Scheme. Palm Island Mayor, Alfred Lacey presented ICAN with email correspondence from a possible scam investor offering to provide financial services to claimants. ICAN was able to have the business in question checked on the spot by Len Curran, Regional Manager at the Queensland Office of Fair Trading.

“OFT began investigating immediately,” said Mr Curran. “The trader appeared to be unlicensed for the services he wanted to offer and the OFT discouraged him from visiting the island.”

“We know that large influxes of money always attract unscrupulous traders,” said Mr Curran. “That’s why these Yarnin’ Money days are so valuable. They allow service groups and regulators to get in early and provide advice and guidance to residents on how to avoid being ripped off. Once consumers are armed with the knowledge, they can make more informed decisions on how to deal with their money.”

ICAN CEO, Aaron Davis said, “The benefits of inter-agency community events like the Yarnin’ Money Day are numerous. They promote collaboration, generate community interest and achieve great service outcomes. We appreciate the support of our partners and plan to continue these Yarnin’ Money community events in 2020.”

Cairns Good Money Store’s, Damian Finitsis said, “Yarnin’ Money Days are a great way to get out in the community with organisations that are doing incredible work. For me, it’s really about strengthening existing relationships and forging new ones.”

The Yarnin’ Money Day event was complemented by a series of Yarnin’ Money financial literacy workshops in Townsville and Palm Island designed explicitly for class action claimants. Final Palm Island Class Action Settlement Scheme payments are due to be released in early 2020. Dodgy traders be warned. We’re watching!

ICAN is pleased to launch its Yarnin’ Money Report 2019. The report examines how ICAN developed and delivered a financial capability program through an Indigenous knowledges framework which involves Aboriginal epistemology and pedagogy, and how Aboriginal and Torres Strait Islander peoples acquired financial capability knowledge and skills through the Yarnin’ Money program over the period of 2015 to 2018.

In late 2014, the Indigenous Consumer Assistance Network (ICAN) received a grant from the Ecstra Foundation to create Yarnin’ Money, a financial capability program wholly developed by and for Aboriginal and Torres Strait Islander peoples. In the 2014 grant round, Ecstra sought to fund projects that would: ‘work to improve the financial literacy and money skills of Australians; provide practical materials that will advance financial literacy in Australia [and] expand the body of knowledge around financial literacy’[1]. As one of the nineteen funded projects in 2014, ICAN piloted the Yarnin’ Money financial capability program which would 1) develop unique financial capability educational content to meet the needs of Aboriginal and Torres Strait Islander peoples; 2) reach a significant number of people in remote and discrete Indigenous communities across North Queensland and the Torres Strait, and; 3) have the ability to scale.

With Ecstra funding, ICAN embarked on a journey to develop a methodology founded within Aboriginal and Torres Strait Islander ontologies (ways of being) and epistemologies (ways of knowing), so as to design a financial capability program that would align with one’s own axiology (ways of doing) within their own cultural frameworks. This methodology was purpose built so as to depart from traditional expectations of what financial literacy programs are expected to achieve and explore what could be possible when a financial capability program is developed and delivered from an Indigenous knowledges framework. In creating the Yarnin’ Money program, ICAN strived towards building a model for how Aboriginal and Torres Strait Islander peoples in Australia can develop meaningful financial capability knowledge and skills that align with Aboriginal concepts of wellbeing and ‘lives lived well’[2].

Key Findings of the report include:

Highlights from the report include:

The Yarnin’ Money Report 2019 can be downloaded here. (10MB)

For further information, please contact:

Carmen Daniels

Research & Communications

m: 0412 357 888

References

[1] Financial Literacy Australia. (2014). ‘Grants program: funded projects 2014.’ http://finlit.org.au/funded-projects/funded-projects2014/.

[2] Grieves, V. (2009). Aboriginal spirituality: Aboriginal philosophy, the basis of Aboriginal social and emotional wellbeing. Darwin: Cooperative Research Centre for Aboriginal Health.

[3] Australian Securities and Investments Commission. (2017). ‘17-361MR ASIC cancels Cairns car dealer’s credit licence.’ October 27. https://asic.gov.au/about-asic/news-centre/find-a-media-release/2017-releases/17-361mr-asic-cancels-cairns-car-dealers-credit-licence/.

Last month, ICAN’s Yarnin’ Money program experienced its largest training group to date, delivering financial capability training to thirty-five job seekers and staff from My Pathway in the Torres Strait. The training featured as part of My Pathway’s Wellbeing toolkit – a range of programs covering physical, social, emotional, cultural, psychological and financial well-being, delivered to job seekers undertaking mutual obligation activities.

Last month, ICAN’s Yarnin’ Money program experienced its largest training group to date, delivering financial capability training to thirty-five job seekers and staff from My Pathway in the Torres Strait. The training featured as part of My Pathway’s Wellbeing toolkit – a range of programs covering physical, social, emotional, cultural, psychological and financial well-being, delivered to job seekers undertaking mutual obligation activities.

Though the Yarnin’ Money training, Torres Strait Islander job seekers and staff were exposed to a unique way of discussing money and related issues, through a culture-centred approach. Yarnin’ Money takes participants on a journey through their own timeline, to understand where and how money fits into one’s own cultural worldview and centres discussion on how histories and life events impact our view and use of money. Facilitators Eddie Buli and Carmen Hegarty discussed how Yarnin’ Money was received in the Torres Strait. “Yarnin’ takes participants on a journey to look and see money – and money issues – from a historical, cultural, personal, family and community view,” Eddie said. “The delivery of the training is about our mob, our communities, our style, our yarn and the way we yarn.”

“That connection to culture and history is an important element of Yarnin’ Money, and this came out strongly in the training,” said Carmen. “We started with the photo narrative activity, as a way to build trust and start the yarn.”

The Photo Narrative activity brought out stories among participants, that are specific to the Torres Strait and daily living on Thursday Island. The trainers noted one man’s chosen photo and story reflected a historical account of the pearl industry in the Torres Strait.

“One participant chose a photo of a pearl lugger and explained the history of the pearl diving industry in the Torres Strait; when they used to dive, how divers came from diverse nationalities and how they all lived their life from the sea,” Eddie explained. “He related how money didn’t matter back then because they could get kai kai [food] from the sea, where the sea was their life. He spoke about how the Torres Strait has changed since the closure of the pearl industry, how these days it is expensive to live on Thursday Island where not much work is available.”

“One participant chose a photo of a pearl lugger and explained the history of the pearl diving industry in the Torres Strait; when they used to dive, how divers came from diverse nationalities and how they all lived their life from the sea,” Eddie explained. “He related how money didn’t matter back then because they could get kai kai [food] from the sea, where the sea was their life. He spoke about how the Torres Strait has changed since the closure of the pearl industry, how these days it is expensive to live on Thursday Island where not much work is available.”

Limited employment opportunities and the high cost of living on Thursday Island were themes discussed during the training. Thursday Island is considered both a remote community and a hub for the rest of the Torres Strait. As at December 2017, ABS reported an 11.4 per cent unemployment rate (of the working age population) on Thursday Island.*

Further to limited employment, is the high cost of living remotely. Yarnin’ Money participants noted the difficulties in being able to manage their finances due to the high cost of living on Thursday Island. “The living expenses here in the Torres Strait makes it hard to manage your life financially,” said one participant. “There’s not enough money, everything’s expensive in the Torres Strait,” said another.

The cost of rent and food were specific issues discussed when delving into high daily living costs that participants faced. “Income from work is never enough for living expenses here, such as food, rent and (the cost of the) power bill,” said another. In a population of 2,938, 77.9 per cent of live in rented properties, with a further 12.3 per cent utilising social housing.** Of those, 11.4 per cent of households on Thursday Island experience a strain in rent payments “greater than or equal to 30 per cent of (their) household income.”** Service Providers in the Yarnin’ Money training also noted the high cost of food shopping on Thursday Island.

The training was well received by the My Pathway service providers and job seekers, with many commenting on how the sessions changed the way they view money and budgeting.

“This training has changed my personal view of how I could save money and also spend correctly.”

“It gave me more understanding, more knowledge, for my future.”

“Giving me a clear picture on budgeting and money handling. Releases stress off my shoulders.”

Participants commented that the skills learned in the training would help them to do personal budgeting and be able to share these skills with family and friends. They commented on how they would use the skills learned by:

“Do up a budget plan with my partner, so we’ll save to maybe go on a holiday with the kids.”

“To teach my family and friends, show them how to solve financial problems.”

“This session was a fantastic opportunity for some of the most financially vulnerable people on TI to get sound financial advice and new ways of thinking about money. People learnt about setting goals and how to budget. A few had one- on one sessions with a financial counsellor. Most of them commented that it was a very useful training session. In addition, My Pathway engagement officers learnt some of the basics around how to help guide and refer people for sound financial advice, tools and tips,” said Bronwen Scully, Well-being Consultant from My Pathway, who organised the training on Thursday Island.

An intended outcome of the Yarnin’ Money training is the follow-on support ICAN provides to participants, through financial counselling offered post-training. ICAN provided financial counselling in response to five requests for assistance, dealing with matters of: multiple funeral insurances (five in total) held by one person, assisting one participant to create a Will, credit and debt issues for one family and tenancy advocacy assistance. ICAN financial counsellors were able to address the multiple insurances, assisting one participant to cancel the bulk of their funeral insurance products, in order to keep what the client felt necessary.

*****

My Pathway provides education, training and employment services and is the largest Remote Jobs and Communities Program (RJCP) provider in the country. Since 2015, My Pathway has been a great support to the Yarnin’ Money program, by organising participants and venues for the team to deliver financial capability training to local community residents in the Northern Peninsula Area (NPA – top tip of Cape York), Mapoon, Napranum, Weipa and recently, Thursday Island located in the Torres Strait.

Yarnin’ Money is an Indigenous financial capability program under ICAN Learn and is supported by the Commonwealth Bank, Financial Literacy Australia, the Department of Social Services and the Queensland Department of Communities, Disability Services and Seniors.

By Carmen Hegarty & Eddie Buli

By Carmen Hegarty & Eddie Buli

Last month, Yarnin’ Money was invited to promote the program to Commonweath Bank staff and its community partners. Yarnin’ Money staff Carmen Hegarty and Eddie Buli delivered training to Commonwealth Bank staff and interns, and community partner organisations including Kari and the Darkinjung Local Aboriginal Land Council. The two-day training was held at the Tranby National Indigenous Adult Education and Training facility, an awesome place situated in the suburb of Glebe.

We were very eager to meet the participants and to showcase the Yarnin’ Money Training in the big smoke. The training itself takes participants on a journey to look and see money – and money issues – from a historical, cultural, personal, family and community view. It’s about our mob, our communities, our style, our yarn and the way we yarn. Through the training, we hopefully shared some awareness via the yarn through Indigenous eyes – not only of the barriers – but aspirations faced by Indigenous people in remote, rural, and urban areas, with regards to financial literacy and consumer issues.

“What stood out for me was that the Yarnin’ Money training is done at a pace which can be unfamiliar to corporates”, said Brad Cooke, Manager – Emerging Technology at the Commonwealth Bank. “The training style properly reflects the needs of the community. It gave time for people in the room to reflect upon their own stories, which reflects the way in which community talk with each other.”

The training also focused on how we can have that understanding when assisting our people towards a healthier financial well-being. Participants were inspired by the concept of the Yarnin’ Money Wheel and how user-friendly it was. It’s a tool that creates a visual picture that allows a person to look at their life from the outside in, and within historical, cultural, personal and community contexts.

“The Yarnin’ Money training occurred at a really good time in my life,” said Megan Wilkin, Finance Officer with Darkinjung Aboriginal Land Council. “The Yarnin’ Money Wheel activity really stood out for me and I actually went home that night and did up a nice, colourful personal Yarnin’ Money Wheel, reflecting my financial journey. I really appreciated the time taken with the training.”

For us, the training was a great way to find a common ground with the bankers, through storytelling or yarnin’. The process of yarnin’ as a form of our knowledge exchange and teaching is the component we want to emphasise. In the right environment, learning can occur when one person can pass on that yarn, through telling stories and sharing information, which has always been part of our traditions. During the training, we were able to make that connection through the yarn, our way of doing things.

“The workshop delivered by Eddie and Carmen was full of great insights and practical ‘handy hints’”, said Noel Prakash, Commonwealth Bank’s Head of Indigenous Banking. “Eddie’s depth of experience and his expertise was reflective of his humorous delivery style, allowing the participants to understand and connect with the complex financial challenges of various communities. His warmest gift was his ability to ‘simplify’ complex financial challenges by community and bring along a diverse group of attendees on a common journey. I was honoured to have my bankers and clients spend the day with Eddie and Carmen.”

“The workshop delivered by Eddie and Carmen was full of great insights and practical ‘handy hints’”, said Noel Prakash, Commonwealth Bank’s Head of Indigenous Banking. “Eddie’s depth of experience and his expertise was reflective of his humorous delivery style, allowing the participants to understand and connect with the complex financial challenges of various communities. His warmest gift was his ability to ‘simplify’ complex financial challenges by community and bring along a diverse group of attendees on a common journey. I was honoured to have my bankers and clients spend the day with Eddie and Carmen.”

Happy New Year everybody and we look forward to where Yarnin’ Money will take us in 2018! Yarn more soon!!!

*****

Yarnin’ Money is an Indigenous financial capability program under ICAN Learn and is supported by the Commonwealth Bank, Financial Literacy Australia, the Department of Social Services and the Queensland Department of Communities, Disability Services and Seniors.

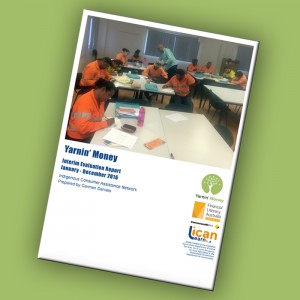

ICAN has just released its interim evaluation report on our Yarnin’ Money financial capability training program. The report discusses the evaluation progress to date on the Yarnin’ Money training program, delivered to twelve remote Aboriginal and Torres Strait Islander communities over a three-year period (2015-2017), with a focus on the development, delivery and evaluation activities of the Yarnin’ Money program from January to December 2016.

ICAN has just released its interim evaluation report on our Yarnin’ Money financial capability training program. The report discusses the evaluation progress to date on the Yarnin’ Money training program, delivered to twelve remote Aboriginal and Torres Strait Islander communities over a three-year period (2015-2017), with a focus on the development, delivery and evaluation activities of the Yarnin’ Money program from January to December 2016.

Yarnin’ Money, funded by Financial Literacy Australia, the Commonwealth Bank and the Department of Social Services, is a three-year outreach program aimed at providing financial literacy tools and skills for local service providers and community residents in remote Aboriginal and Torres Strait Islander communities across Far North Queensland. Yarnin’ Money is developed and delivered through a culture-centred training approach, which recognises existing Indigenous cultural worldviews and knowledge as the foundation to build new financial capability skills. The program aims to overcome geographical barriers by providing local financial literacy training coupled with ongoing support, by connecting ICAN’s financial counselling and capability services to remote communities across Australia.

ICAN’s ongoing evaluation seeks to examine how the program increases knowledge, confidence and skills towards financial capability by specifically embedding Indigenous worldviews and cultural components which are delivered through storytelling, to create a ‘yarn’ about money. “If we start Yarnin’ about this thing Budget/Money and we understand this component in our lives, we can try and be boss of it as best we can. Yarnin’ about Money is the start of where we are today, to where our young people and generations to come, going to be in relation to how we perceive Money,” said Eddie Buli, Yarnin’ Money developer and trainer. It also seeks to discuss the context in which financial capability learning occurs for Indigenous peoples and how context affects learning.

Key findings from the report include a discussion on how the training delivery and activities promote cultural safety, which has been the necessary foundation for opening participants up to be able to discuss money within a safe environment, how the training creates opportunities for ‘teachable moments’ and also discusses challenges met.

You can download the Yarnin’ Money interim evaluation report at: http://ican.org.au/wp-content/uploads/2017/04/ICAN-Interim-Eval-Report.pdf or from the Financial Literacy Australia website at: http://finlit.org.au/funded-projects/funded-projects2014/indigenous-consumer-assistance-network-ican/.

Financial Literacy Australia (FLA) is a not for profit organisation committed to advancing financial literacy in Australia. See http://finlit.org.au/ for more information.