Today, ICAN releases its literature review: A study of local economic abuse in First Nations communities with a special focus on Australia and Canada. The study was undertaken by Professor Jerry Buckland from the Canadian Mennonite University (CMU) and Carmen Daniels, Research Manager at ICAN.

ICAN’s purpose in undertaking the research, was to review the literature on the national (Australian) and broader international First Nations’ experiences (Canada) with local economic and financial abuse, with results that generated a focus on three areas: intimate partner violence, abuse flowing from social sharing, and fringe lending such as book up schemes.

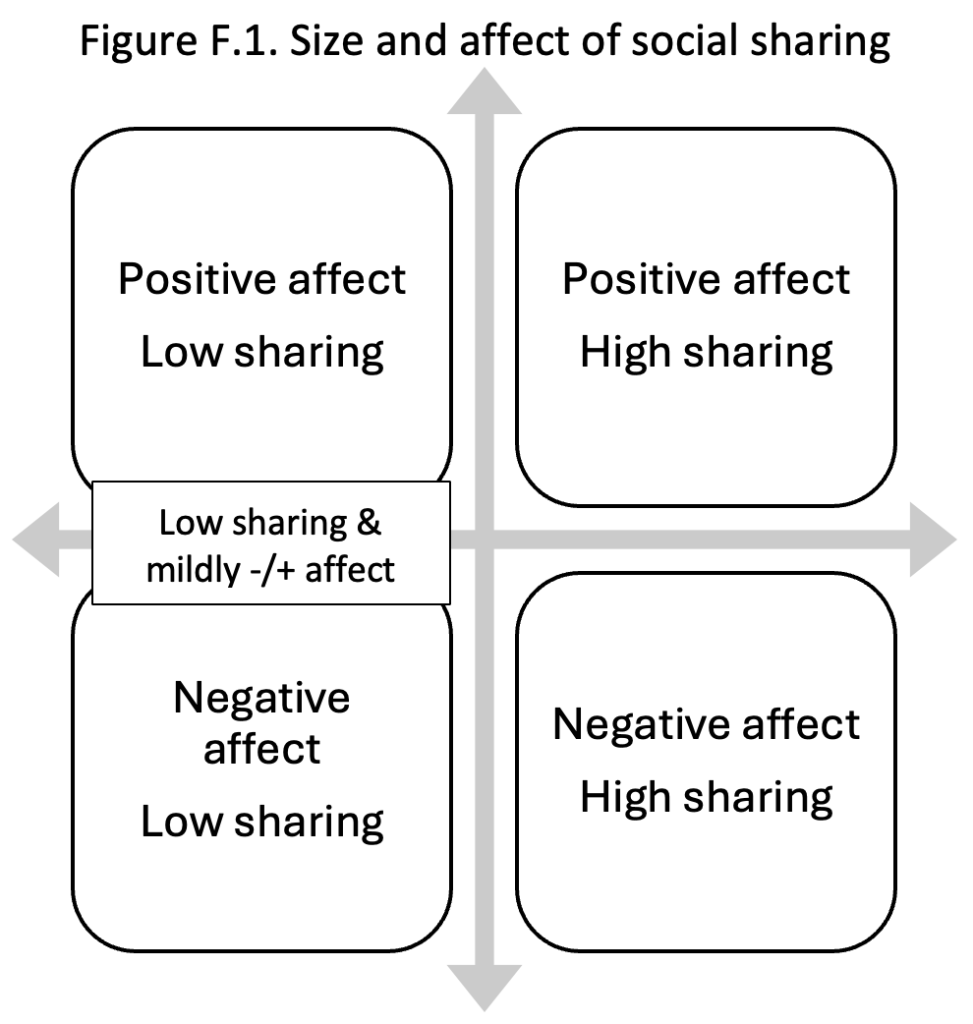

In addition to undertaking a scan of the literature, the study also includes two focus groups with First Nations peoples, who provided knowledge and insight into how peer and family based financial abuse might transpire and how it may or may not be acknowledged in everyday practice. Twenty-two examples of family sharing practices and financial abuse were discussed in the focus groups and were plotted along a two-dimensional continuum: size and affect with four quadrants: positive affect and low sharing, positive affect & high sharing, negative affect and low sharing, and negative affect and high sharing.

Working from a nested economic abuse framework, the study identified six results for consideration:

(1) Financial management within a sharing system is complex:

First Nations peoples manage complex socio-economic sharing systems and make decisions that require balancing the needs of themselves, their immediate family, their extended families for today and the future. When making decisions about sharing money, giving money, or responding to requests for money, people are making decisions about ‘now’ and the ‘future’ based on immediate need and future need of them, their immediate families, and extended families. This ontological positioning is fundamental to how the complexities of how First Nations’ socio-economic sharing systems are managed and will determine if a person perceives the relationship to be sharing or financial abuse.

(2) First Nations Peoples face a dynamic changing cultural and economic landscape:

The literature that we found documented that economic abuse is taking place during a time of rapidly changing culture and economy for First Nations peoples in the CANZUS regions and particularly, where we found most data, in Australia and Canada. While studies have not measured levels of economic abuse or compared it over time, some studies argue that economic abuse today is related to this rapid cultural and economic change in First Nations communities (Bird, 2011; Owen-Williams, 2012). First Nations peoples continue to experience colonisation, some are migrating from rural to urban locations. This leads to increasing interaction with hyper-capitalist consumer culture, becoming more integrated in formal education systems, and gaining formal sector employment. This rapid change offers opportunities and challenges.

(3) Silence and (4) ambiguity can reinforce economic abuse. Not speaking about partner- and peer-based economic abuse can aggravate the problem. One study highlighted critical nature of an effective response to this is to promote education around economic abuse and to embed cultural values and principals into educational methods and practice.

In some cases, partner- and peer-based economic abuse has an ambiguous affect on the affected persons and/or families, making it difficult to clearly identify practices of financial abuse. Focus group findings noted stories of individuals perceived their own actions of supporting others (at their own expense) as helpful, where group participants clearly felt the circumstances qualified as financial abuse. Studies noted First Nations’ principles of healing and working together were useful ways of being when addressing financial abuse.

(5) Certain people are most vulnerable:

The literature and focus group meetings aligned in identifying groups of First Nations peoples who are most vulnerable, with a well-documented recognition of how vulnerability can be multiplicative through processes in the Intersectional literature.

(6) Local retail schemes using book up and other fringe credit products can harm people:

Where there are little to no financial services options in remote communities, studies found higher reliance on book up and fringe lending. Weaker regulation around the use of such products may lead to increasingly abusive practices offering little to no redress options for affected groups.

This study was funded by CommBank Next Chapter. For more information, please contact: Jerry Buckland, email: jbuckland@cmu.ca or Carmen Daniels, email: carmen.daniels@ican.org.au.

Download the study here: A study of local economic abuse in First Nations communities with a special focus on Australia and Canada