“Super funds excel at collecting our money, but miserably fail us when we need it most,” say advocates demanding immediate reform.

A scathing report by the Australian Securities and Investments Commission (ASIC) released this week reveals alarming delays, distress, and inequity in superannuation claims handling, disproportionately impacting First Nations families. Leading Indigenous advocates urgently call for parliamentarians to establish mandatory, legislated customer service standards to address these systemic failures.

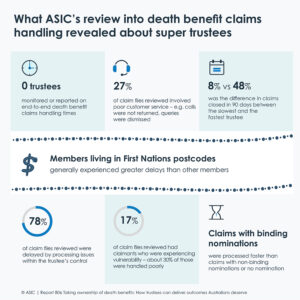

ASIC’s review highlights troubling delays and procedural barriers, underscoring a systemic lack of culturally appropriate support. The report describes cases where grieving families faced prolonged waits of more than 500 days due to inflexible identification processes and insensitive interactions, compounding financial distress and emotional trauma.

Critically, ASIC found that most superannuation trustees lack comprehensive data on their First Nations members, severely limiting their ability to provide tailored services. Though some trustees have initiated positive changes, such as developing dedicated contact centres and cultural competency training, overall progress remains inadequate.

In response, ASIC urges the superannuation industry to improve data collection methods to identify better and support First Nations members. The commission also calls for greater flexibility in identification procedures. It stresses the need for trustees to make timely interim payments for funeral expenses, recognising the deep cultural significance of funerals within First Nations communities.

Mark Holden, Senior Solicitor and Policy Advocate at Mob Strong Debt Help highlighted the trust deficit. “Super trustees thrive on our trust, we give them our money in good faith, yet they consistently fail us during critical moments such as losing a loved one,” Holden said. “This report confirms that trustees aren’t adequately finding beneficiaries or processing payments fairly.”

Key issues identified in the ASIC report include:

- Excessive delays in processing death benefit claims, particularly affecting remote First Nations communities.

- A lack of data on First Nations or vulnerable members who need tailored assistance.

- Deliberate risk-averse practices cause unnecessary harm during Sorry Business, even when a binding nomination exists.

- Culturally insensitive processes create barriers that discourage First Nations people from accessing their rightful benefits.

Bettina Cooper, Senior Financial Counsellor at Mob Strong Debt Help, emphasised the broader implications. “The super system is actively hindering our efforts to close the intergenerational wealth gap by erecting unnecessary barriers,” Cooper stated. “Funds must urgently identify and support vulnerable consumers.”

Advocates call for clear, enforceable customer service standards within the superannuation industry, including defined processing timeframes, culturally appropriate communication in plain language, and compulsory cultural competency training for fund staff.

Aaron Davis, CEO of the Indigenous Consumer Assistance Network (ICAN), likened the current system to a “modern form of stolen wages,” criticising its design flaws. “The superannuation rules ignore the stark reality of lower life expectancy among First Nations people, showing an astonishing lack of foresight and sensitivity,” he said.

Lynda Edwards, Director of First Nations Policy at Financial Counselling Australia, described a system overwhelmed by bureaucracy. “Financial counsellors face endless obstacles in helping clients access money that rightfully belongs to them,” Edwards noted. “The system is not just slow it’s actively failing grieving families.”

Unaisi Buli, a Financial Counsellor at ICAN, recounted a client’s experience in Cape York: being forced to move super funds just to access financial hardship relief. “When our clients need their own hard-earned money, the multitude of barriers can feel insurmountable,” Unaisi explained. “This experience is demoralising and deeply discouraging.”

Advocates assert this is a pivotal moment for superannuation reform, demanding action from the next Assistant Treasurer regardless of election outcomes to deliver justice for First Nations members whose current system has persistently failed.