FCAQ recently released its report ‘Give Financial Counselling in Queensland a Fair Go’ requesting $15M per annum from the Queensland Government over five years to support state-based financial counselling services. With the burgeoning demand for services and the cost-of-living crisis, we asked ICAN’s Operations Manager, Jillian Williams, how the sector is coping when there’s just no letting up.

Great to yarn with you again Jill!

First up, with an unprecedented surge in demand for financial counselling services across Australia, how is the sector coping?

Financial counsellors are incredibly resilient professionals who, despite surging demand for their services, can maintain their commitment to and focus on the needs of the people seeking their help. The concern for financial counsellors when demand surges is how we can help as many people as possible through these really tough times. Despite that passion and resilience, the fact that there are too few financial counsellors to assist the many people who need our help impacts the wellbeing of the people in our sector. As community service providers, we live and work alongside the people who need us. We see the pain and know that financial counselling can ease the significant stress that so many people are living with. It inevitably takes a toll on us when we can’t get to those people.

Financial counsellors are facing an overwhelming demand for services. How does chronic demand impact their wellbeing and morale?

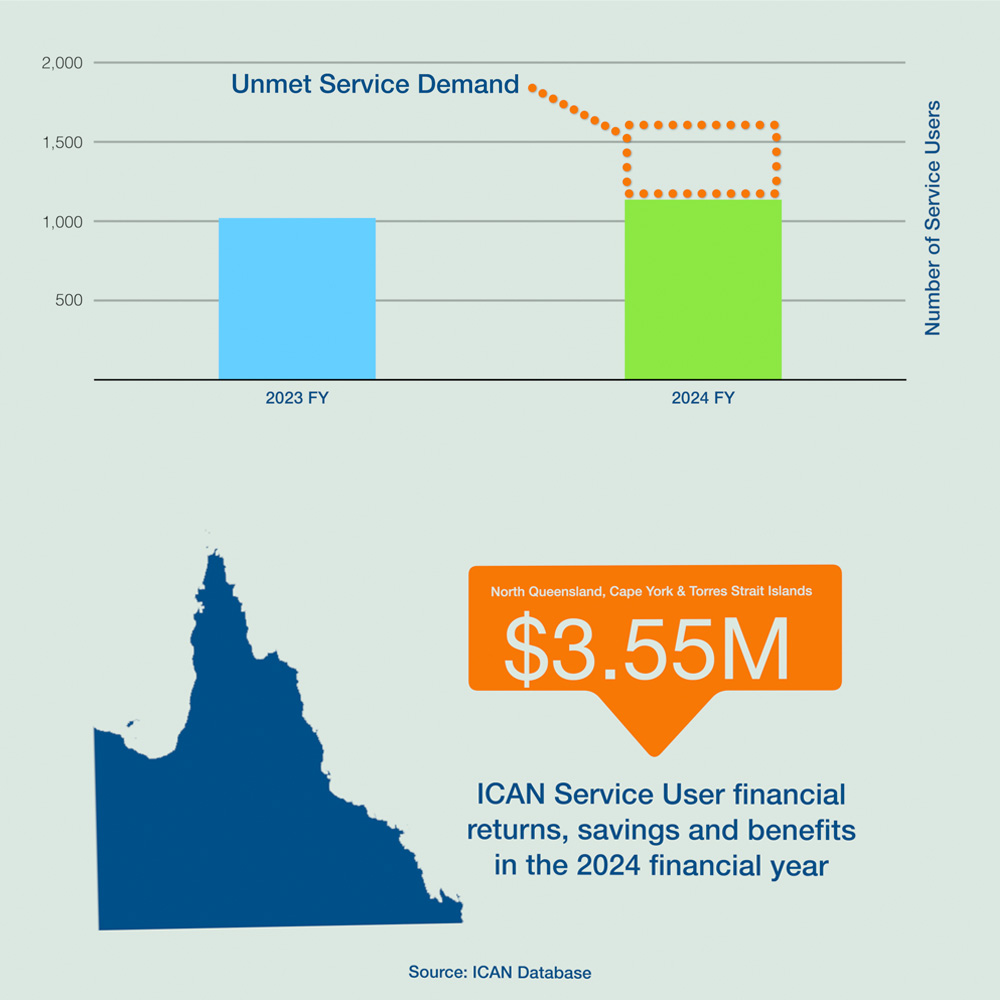

Financial counselling services manage demand differently depending on the communities in which they work. ICAN has always had a waitlist of clients seeking our help. As this wait list has grown over the past 4 years, it has come to represent the significant gap between demand for our service and the number of financial counsellors available to assist. Our team view the waitlist regularly as part of our triage services; it is an ever-present reminder that we can’t get to everyone we need to. Knowing that people are having to wait too long to get to us inevitably impacts morale and wellbeing. When care and passion for the work you do to support people collides with the stress of not being able to help enough people, burnout occurs. This can have a knock-on effect across teams, and overall morale and wellbeing take a hit. We constantly manage the pressure to support more people than we can realistically assist at any given time.

What is the largest barrier to people in financial hardship accessing financial counselling?

Currently, the biggest barrier is that there are simply not enough financial counsellors to meet the demand for this vital service. We have a waitlist of over 6 weeks across all of our offices and have had to turn new clients away many times because we simply did not have enough financial counsellors to see the many people contacting us for the first time to get help.

The other challenge is that many people have no access to face-to-face financial counselling, particularly in regional and remote communities, who desperately need these services. Travel to these communities is not funded, and the significant hurdles people face with poor digital connectivity and low digital literacy means that phone and internet services are not always effective. People can experience overwhelming shame in talking about finances. Face-to-face contact is often necessary to build trust in the financial counsellor so that a person feels safe enough to open up about their money worries.

Do organisations face any risks due to ongoing chronic service demand?

Organisations can lose some of their best people when staff are burning out due to overwhelming demand. In and of itself, this is a terrible outcome. We don’t want peoples’ wellbeing impacted through the work they do. At an organisational level, it means we have to recruit and train new people in the role, which can have a flow-on effect with experienced staff needing to work harder to support the development of trainees while also managing more complex client casework. This training period is important – we want new people entering the sector! However, there has to be funding to support their development to take on more complex casework. There are no easy solutions to these workforce issues, particularly if there is insufficient funding to support professional development and the costs of structural changes often needed to support teams.

How do people under financial stress respond when advised they must be waitlisted or referred elsewhere?

In all honesty, it depends on the person. Most people are understanding and quietly accept our wait times – this doesn’t mean they aren’t hurting; it just means they don’t like to complain. Then, there are those our reception team engages with daily who express their understandable stress and frustration about waiting. Their reactions are in response to the reality that they are in so much debt they can’t put food on the table for their kids, or their sole means of transport – the family car – is at real risk of being repossessed, or their rent is so far behind they are facing eviction. Whatever peoples’ reactions to their situation and the challenges in engaging with services, we know everyone is doing the best they can in really difficult situations.

In all of this, receptionists are the unsung heroes of the community sector. They are skilled in tackling really challenging and often very emotional conversations with people in the community who are hurting. They are the first interaction that people will have with a service and can be the difference between a person feeling confident and safe enough to pick up the phone and engage with the service again.

FCAQ’s survey revealed Queensland Financial Counsellors want funding for more specialist training in gambling, domestic violence, prison work, and small business. What are the benefits of investing in this training?

The benefit of investing in this training is that we build a financial counselling sector that can work with people across the community who have complex needs. Fewer people are turned away because the service doesn’t feel they have the skillset to assist.

Working with someone who has a gambling addiction (or any form of addiction) or someone who has experienced domestic violence requires specialised knowledge of how these experiences are impacting their finances and their wellbeing. For example, addictions, whether gambling or otherwise, impact peoples’ money story and working with them to resolve their money issues can be challenging if they are not ready to admit to the addiction or address it. For people experiencing domestic violence, their safety is paramount and ensuring our work does not threaten this is critical and not always straightforward. For instance, getting a joint debt waived that results in the perpetrator being forced to pay immediately puts the victim/survivor at risk of violence. We have to work to minimise this risk while also ensuring the victim/survivor is not carrying the financial burden of the perpetrator’s debts. Working with people in prison fundamentally involves a different way of working. There are barriers to engaging with financial services that people outside prison don’t experience, and financial counsellors have to find workarounds that aren’t required in usual service delivery.

And then there are specialist areas of work that require an understanding of different laws and systems but equally involve working with people experiencing significant stress, such as small business operators who have lost their business.

For all of these people, it is necessary to understand the impact of any trauma they may have experienced or are experiencing through their individual situation. These are all complex skills requiring an understanding of addiction; mental health; and the criminal justice and financial services systems.

The BOM predicts a scorching summer for Australia and potentially severe weather nationwide. With financial counselling services already stretched, how can the sector cope with climate change disasters without the necessary funding?

The blunt reality is that we can’t. Current funding is not meeting the demand in the communities that have not been impacted by climate disasters. When a disaster strikes, as it did for us in Cairns following cyclone Jasper, there is no additional resourcing that can be employed to reach the people affected. Services are stretched too thin on the ground as it is. And often, even where funding is provided, it is not as simple as recruiting more financial counsellors. There just aren’t enough qualified financial counsellors in regional areas, so investment in training and developing new financial counsellors in regional areas is critical so that we have qualified people available to respond when a disaster strikes.

As the demand for financial counselling services grows, what developments do you think will shape the sector’s future?

As the sector gains much-needed support from industry funding in the coming years, it will be important for us to hold the activism that has been at the heart of this sector from its inception at the forefront of our minds. Demand is growing in large part because there continues to be poor responses by industry to the hardship people face, and exploitation of people’s hardship inevitably occurs in some pockets of industry. As we enter this new funding landscape, we must be confident as a sector in calling these industry failings out and not be fearful of taking strategic action when our concerns are not heard.

In addition, increasing demand for financial counselling services will require our sector to adapt and trial different ways of providing our services. Intake, referral and service delivery processes may change as services seek better, more efficient ways to meet demand. Other community services will be similarly adapting, which opens up real opportunities to create a more networked and integrated community service sector that can respond holistically to the needs of the community.

However, there is a risk that community services increasingly relying more on centralised, digital platforms to deliver services, just as government and private industry already have. While these platforms may work well for many people, they pose significant barriers for those in the community who experience digital exclusion and other vulnerabilities. These are people who will always need to have direct contact with the person with whom they have to share their story and their fears in order for them to move from surviving to thriving. These are the interactions that give our sector its heart. As services adapt and innovate, this reality can never be forgotten, because removing that contact for the sake of simply ‘helping’ more people faster will not meet the underlying needs of the people seeking our services.

Read the FCAQ Report ‘Give Financial Counselling in Queensland a Fair Go’ here

If you would like to support ICAN’s work, you can donate here