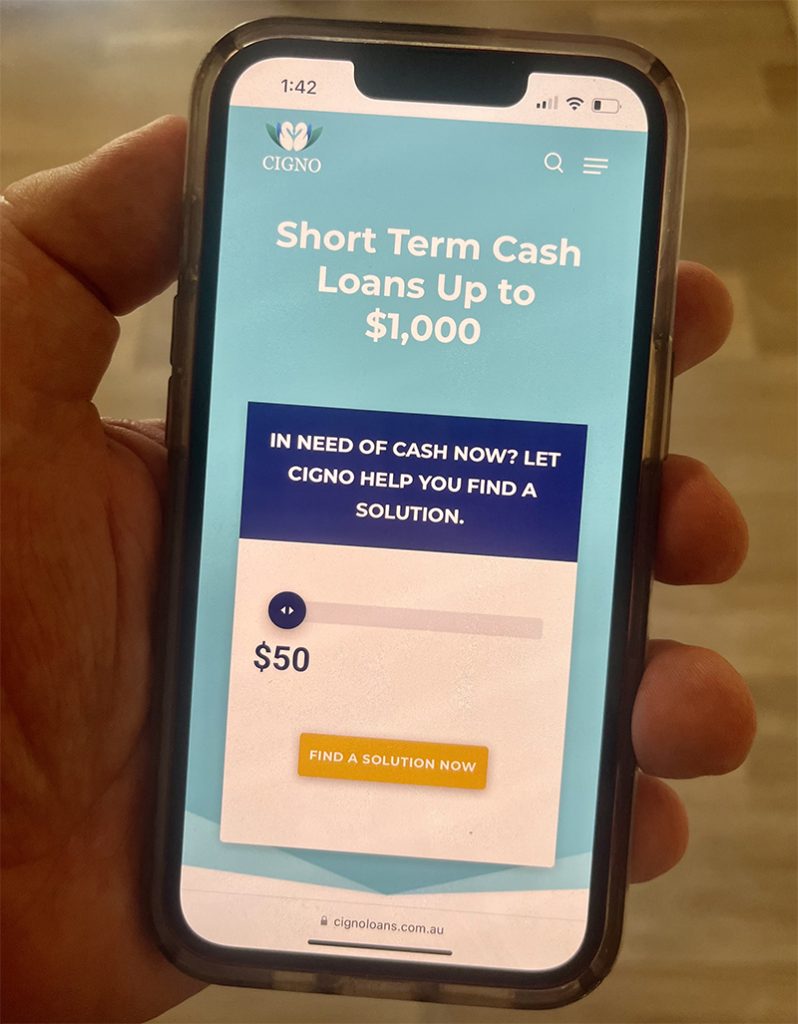

ASIC has been successful in its action against Cigno Pty Ltd (Cigno) and BHF Solutions Pty Ltd (BHF Solutions), with the Federal Court finding that both companies engaged in credit activities without holding an Australian credit licence. ASIC also obtained permanent injunctions against Cigno and BHF Solutions to protect consumers.

The decision came after ASIC appealed the original Federal Court decision which had found in favour of Cigno. ICAN CEO Aaron Davis said, “ICAN applauds ASIC’s persistence in ensuring Australia’s most vulnerable consumers are protected. When companies like Cigno build their business model on getting around the laws that were created to protect consumers, we have a real problem.”

ASIC Deputy Chair Karen Chester welcomed the decision, saying, ‘ASIC took this case to stop a harmful lending model, one which circumvented Australian credit laws and regulations and charged excessive fees and charges to many vulnerable consumers.’

ICAN Operations Manager, Jillian Williams said, “Cigno was the highest reported private creditor that we were seeing in our casework throughout 2021 and 2022, only recently being overtaken by Money 3, which is also now being litigated by ASIC. A common theme we witnessed, is that people were paying excessive fees for small loans, putting them in a significantly worse financial position. This in turn exacerbated other issues going on in their lives.”

At the time ASIC commenced proceedings in 2020, BHF Solutions was writing more than 1,000 loans each day. ASIC took the matter to Court with the primary objective of stopping BHF Solutions and Cigno from using this harmful lending model. ASIC has stated that it is committed to protecting consumers from predatory lending practices and high-cost credit.

“Companies like Cigno and BHF solutions prey upon people in vulnerable financial circumstances, that feel like they don’t have any other option,” said Ms Williams.

During the high court proceedings, ASIC presented an example of a borrower with a $200 loan, that paid $177.75 in fees over a two-month period to BHF Solutions and Cigno. The same borrower went on to borrow a further $600, ultimately paying another $703 in fees.

Justice Halley found that the objective purpose of the lending model established by BHF Solutions and Cigno was to avoid the provisions of the National Credit Act and National Credit Code which provide for the protection of consumers from disproportionate fees and charges.

The injunctions prevent Cigno and BHF Solutions from operating this lending model or collecting repayments and fees from consumers on loans provided under this particular model.

ASIC expects that Cigno and BHF Solutions will notify any affected consumers to ensure they are not paying any fees or charges covered by the injunctions. ASIC also expects that both entities have processes in place to ensure ongoing compliance with the injunctions.’

ASIC has reported that it is investigating another lending model involving Cigno Australia Pty Ltd and BSF Solutions Pty Ltd, which are related entities of Cigno and BHF Solutions.

Related Stories