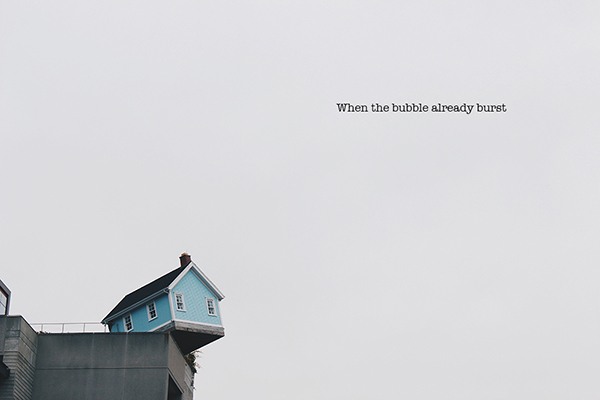

This time last year, ICAN E-News reported on the financial counselling case complexity experienced in our Townsville office due to the dramatic economic downturn in the region. With significant media attention on Australia’s housing bubble last week, most notably ABC’s four corners episode ‘Betting on the house’, we thought it was time to see if the economy has changed for the capital of North Queensland and what this has meant for our financial counselling team.

We reported last year that the June 2016 unemployment figure was at 14.8%, it’s now 9.5%, but still 3% over the 6.5% state average. The June 2016 quarter personal insolvencies were at 154 compared to 106 in the June 2017 quarter, however Townsville is still sitting at 18.9 insolvencies per 100,000 people higher than the Queensland average of 70.4 insolvencies per 100,000 people. Townsville house and unit prices had declined 9.7% and 13.5% respectively over the previous 5 years with only minor recent gains.

So, what does this all mean for ICAN’s financial counselling team, servicing a region that is only slightly recovering from a bubble that has already burst? ICAN’s 2016/17 financial counselling data reveals that 19% of our Townsville office’s client primary case load was directed at either providing advice or taking clients through the insolvency process and a further 64% directed at dealing with debt and credit issues. ICAN Financial Counsellor, Ray Kent says, “We should not be seduced by a few signs of apparent economic upturn in Townsville. For many households, deciding whether to pay debts or buy food remains a constant pressure.”

ICAN Financial Counsellor Martina Kingi is disturbed by the significant number of female clients escaping domestic violence saddled with debts from high interest short term loans and consumer leases for household goods. Ms Kingi explained, “Our clients mostly rely on payday loans and credit cards to pay everyday household expenses like food. These debts only add to their misfortunes and always spiral out of control. If we get onto the financial and associated issues sooner, we’re always in a much better position to negotiate with creditors and utilise our extensive referral support networks.”

ICAN CEO Aaron Davis is planning to increase Townsville’s financial counselling staff over the next couple of months, with the recruitment of new financial counselling and financial counselling support officer positions. “We’re hoping these extra resources will help people suffering financial stress and the increasing need within the region,” said Mr Davis. “My advice is that if you lose your job, become ill or your relationship breaks down, go see a Financial Counsellor straight away before any financial issues get to big.”

ICAN’s office is located at Unit 2, 95 Denham St Townsville CBD, appointments can be booked by calling 07 4417 1900 or 1300 369 878.