New Report Released Today: From surviving to thriving: Embedding a well-being framework into financial counselling practice

In 2020, the Indigenous Consumer Assistance Network (ICAN) set out to widen the scope of its financial counselling services by looking at how it could deliver a holistic financial counselling framework that could better meet the financial and well-being needs of its service users. Over the past three years, ICAN has been developing a practice framework for its financial counselling services that embeds elements of the Sustainable Livelihoods Framework. Today ICAN has released the report: From surviving to thriving: Embedding a well-being framework into financial counselling practice that shares the learnings from this significant organisational undertaking.

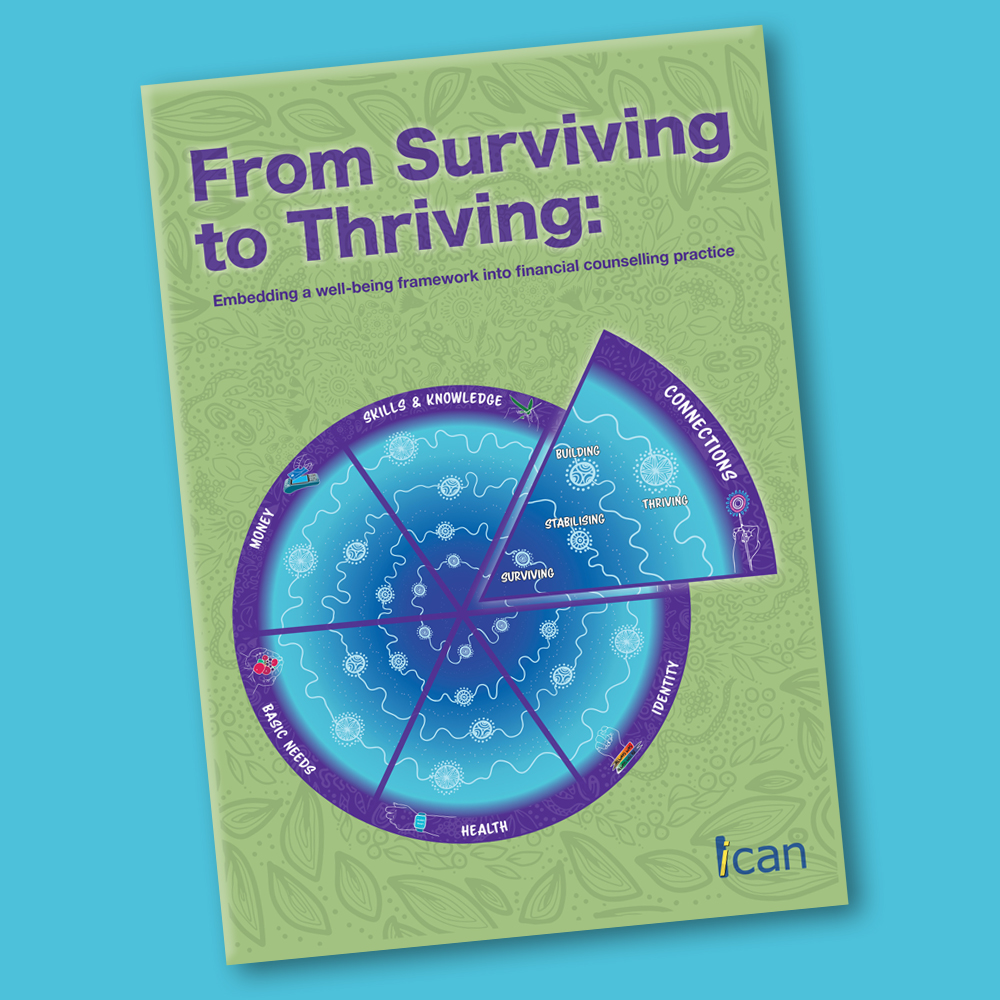

The implementation research study was driven by the organisation seeking to understand the methods and processes undertaken by ICAN financial counsellors when they’re working with service users in each of the four stages of the Sustainable Livelihoods continuum of: ‘Surviving’, ‘Stabilising’, ‘Building’ and ‘Thriving’. From this learning, ICAN developed a practice framework to understand the three elements that underpin its holistic practice: elements of the “FC process” scale down, elements of the “Empowerment process scale up and how building and maintaining working relationships with clients remains constant throughout the holistic financial counselling process.

Carmen Daniels, ICAN Research Manager and author of the report explains how the Sustainable Livelihoods Framework helped ICAN to understand how it could deliver a holistic financial well-being service to help its service users move beyond the crisis stage.

“The report examines the connection between ICAN’s financial counselling work and the surviving to thriving continuum, and at what stage an empowerment process developed for its service users,” she said.

In addition to developing the practice framework, the organisation also constructed tools that embedded elements of the Sustainable Livelihoods Framework to aid financial counsellors to support service users to achieve greater well-being outcomes and longer-term impacts.

“When the financial counsellors used the framework in their client work, there were increased opportunities to identify, attain and evidence greater well-being outcomes for the service user, because we were able to understand more about their needs, goals and aspirations,” said Jillian Williams, Operations Manager.

“The 76-page report is a comprehensive record of our organisation’s service and impact measurement journey over the past 4 years,” said Aaron Davis, ICAN CEO.

“We hope that like-minded organisations who are interested in delivering holistic financial well-being services and measuring impact can use this report to help inform their own practice.”

For more information on the report, please contact:

Carmen Daniels, Research Manager: 0412 357 888 or email: carmen.daniels@ican.org.au