Queenslanders currently have $170,895,033 million dollars of lost superannuation sitting idly in accounts just waiting to be claimed. In data recently released, the ATO announced they are holding a whopping $17.5 billion dollars of lost or unclaimed super nationally.

Queenslanders currently have $170,895,033 million dollars of lost superannuation sitting idly in accounts just waiting to be claimed. In data recently released, the ATO announced they are holding a whopping $17.5 billion dollars of lost or unclaimed super nationally.

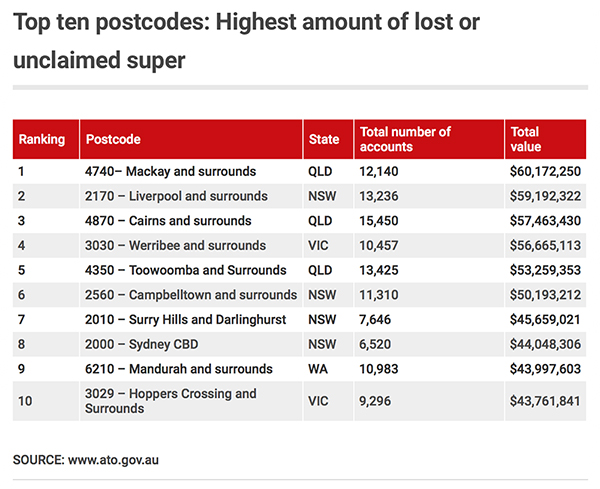

Queensland scored the No 1 spot on the ATO’s Top 10 list of lost super postcodes, with Mackay in first place ($60,172,250), followed by Cairns in third place ($57,463,430), with Toowoomba coming in fifth (53,259,353).

ATO Assistant Commissioner Graham Whyte said people often lose contact with their super funds when they change jobs, move house, or simply forget to update their details.

“We know that more than a third of Australians still hold two or more super accounts. While some people intentionally maintain multiple accounts, a lot of people are unaware of this, and that their super is possibly being eroded by fees.”

In July 2018, the award winning superannuation outreach event the ‘Big Super Day Out’, headed and hosted by the First Nations Foundation, toured Qld helping Indigenous communities to find, consolidate and build their super. ICAN was on hand to lend a hand at these events in both Cairns and Palm Island, where a total of 90 participants were reunited with $2.6M and $1.2M of their superannuation, respectfully.

As a Financial Counsellor with ICAN, Unaisi Buli also regularly helps clients track down their lost super, and is aware of some of the obstacles that can get in the way of reconnecting people with their funds.

“We often have clients travelling to Cairns from remote communities for medical treatment that may end up staying for months at a time and need to access their super to pay bills. It’s important to get the word out to clients to remember to bring their personal ID such as a driver’s licence or birth certificate when travelling away from community, so they can be reconnected with their super as quickly as possible” explained Unaisi.

“It’s also critical for clients to nominate a beneficiary for their super. For example, if a loved one passes without a will or beneficiary, it may be difficult – or even impossible – to access their relative’s superannuation, so events like the Big Super Day out are providing a critical service to remote communities.”

Mr Whyte encouraged Australians to visit the ATO website and check to see to see if a portion of the lost $17.5 billion belongs to them, and suggested that anyone with multiple accounts should consider if consolidating their accounts might be worthwhile.

“If you’re not sure whether to consolidate, check with your super fund who can advise you on issues such as insurance that may be attached to your accounts,” he said.

Unaisi agreed that multiple super accounts can also mean multiple fees, which can quickly strip a super account of its funds and recommended sticking to the fund with the lowest fees.

“Our advice is to remain engaged with your super fund through all stages of your career, not just when you’re ready to retire.” said Mr Whyte.

For information on how to manage your super and view all your accounts including lost and unclaimed super, contact ICAN on 1300 369 878. You can also check out the following websites: fnf.org.au/big-super-day-out or ato.gov.au/checkyoursuper