More than 110,000 people in Far North Queensland could be eligible to borrow money for essential goods and services and pay no or low interest through the region’s first Good Money community finance store.

More than 110,000 people in Far North Queensland could be eligible to borrow money for essential goods and services and pay no or low interest through the region’s first Good Money community finance store.

Good Money opened earlier this month at the Cairns Show Grounds Shopping Complex on Mulgrave Road. The store provides access to the No Interest Loan Scheme (NILS) and the StepUP low interest loan, helping people on low incomes by offering a better alternative to the high fees that come with cash loans and expensive consumer lease contracts.

People living on low incomes can use NILS to borrow up to $1,200 for essential goods and services such as furniture, whitegoods, computers, medical expenses and educational costs, and can make repayments over a 12 to 18-month period.

The Good Money store is part of an innovative partnership between Good Shepherd Microfinance, the Queensland Government and National Australia Bank (NAB). Good Shepherd Microfinance Chief Executive Officer, Adam Mooney, said there are many people in the Far North Queensland region who could be eligible for a NILS loan.

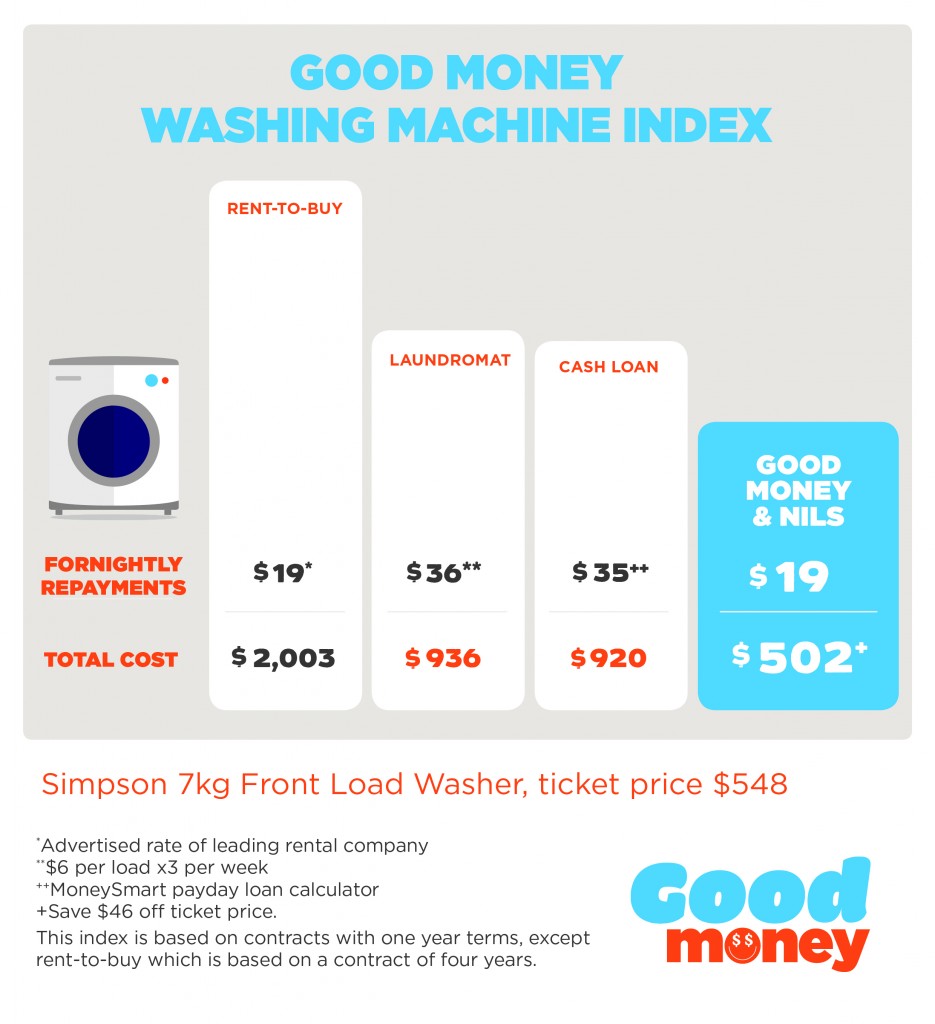

“We know there’s more than 110,000 people in the Far North Queensland region who would be eligible for a NILS loan through Good Money,” said Mr Mooney. “That loan could buy a fridge or a washing machine for a family in need and help them to take control of their finances and make informed decisions. Sometimes people feel that they don’t have any alternative other than to take out a cash loan or a consumer lease to cover the cost of essential items like a new washing machine. A rental contract for a $550 washing machine could cost more than $2,000 over a four-year period, but, with NILS, you won’t pay a single cent more than the value of that washing machine.”

“We know there’s more than 110,000 people in the Far North Queensland region who would be eligible for a NILS loan through Good Money,” said Mr Mooney. “That loan could buy a fridge or a washing machine for a family in need and help them to take control of their finances and make informed decisions. Sometimes people feel that they don’t have any alternative other than to take out a cash loan or a consumer lease to cover the cost of essential items like a new washing machine. A rental contract for a $550 washing machine could cost more than $2,000 over a four-year period, but, with NILS, you won’t pay a single cent more than the value of that washing machine.”

NAB Head of Financial Inclusion, Elliot Anderson, said that Good Money will help people who don’t qualify for a personal loan from mainstream banks. “We see people who don’t qualify for a personal loan but who need a small amount of money to get them through a tough time. We want to help them because we know that a small amount of credit can be all that’s needed to prevent people falling into a cycle of unaffordable debt,” Mr Anderson said. “That’s why we’re committed to addressing financial exclusion through supporting initiatives like Good Money. NAB is the only bank to have taken real action on the issue of financial exclusion by providing $130 million in loan capital to microfinance because we believe in helping more people to become financially successful and through this, supporting our nation to prosper.”

In addition to Good Money stores, the NILS program is offered through a network of community providers in around 140 locations across Queensland. Good Money stores also offer low-interest StepUP loans in partnership with NAB for up to $3,000, and information about Essentials by AAI, an insurance product designed for people on low incomes in partnership with Suncorp.