As we come to an end of another year, we reflect on how ICAN has carried out our mission of Empowering Indigenous Consumers, over the last twelve months…

As we come to an end of another year, we reflect on how ICAN has carried out our mission of Empowering Indigenous Consumers, over the last twelve months…

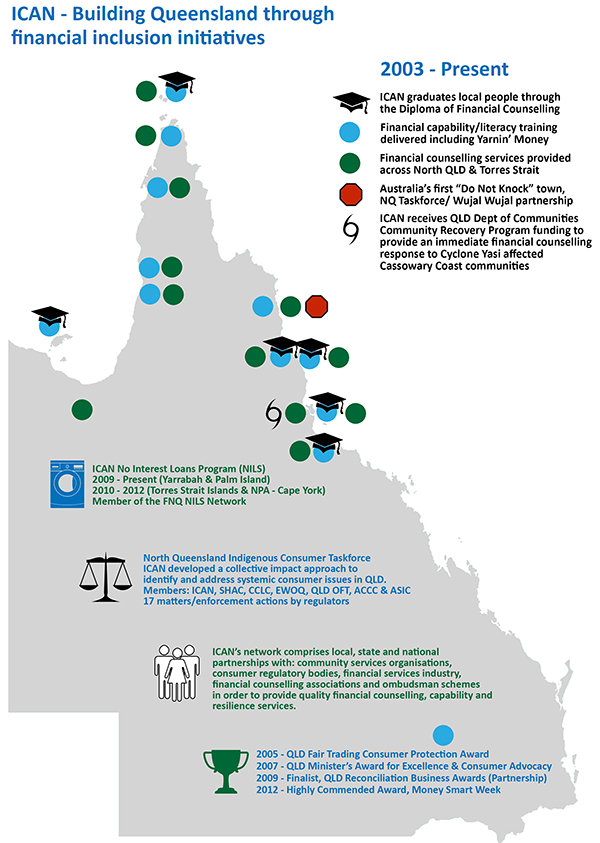

In partnership with the Wujal Wujal community, ICAN and members of the North Queensland Indigenous Consumer Taskforce commenced the year with the launch of Australia’s first Do-Not-Knock town, unveiling roadside signage designed to minimise consumer harm from unlawful door-to-door trade. The signage, placed on both entrances into the Cape York community, reminds door-to-door traders they have legal obligations to consumers and can’t approach houses displaying do-not-knock notices. It was a significant achievement for the Taskforce, demonstrating its belief that a collective impact approach (in consumer organisation / community / regulator relationships) can be an effective way to identify and address systemic issues being experienced by remote Indigenous communities. It piloted an innovative approach to combat consumer exploitation often occurring in remote communities. The historic partnership between Wujal Wujal Aboriginal Shire Council and Taskforce members received national media attention and was aired on Channel 10, ABC and NITV News. The coverage sent a strong message to viewers of the need to understand and assert your rights under the Australian Consumer Law.

This year also marked the graduation of fifteen Aboriginal and Torres Strait Islander students through our ‘Indigenous Financial Counselling Mentorship Program’, achieving their Diploma of Financial Counselling. This was a significant achievement for the students, who traveled from across Australia – from Kempsey (NSW), Ceduna (SA), Melbourne (VIC), Cairns and Mornington Island (QLD), Alice Springs and Darwin (NT) – to participate in the 18-month program. Over the duration of the program, we introduced the Mentorship Program students to E-News readers as they progressed through their Diploma studies. When ICAN and our partner the Commonwealth Bank set out to increase the number of Indigenous financial counsellors throughout Australia, there were less than a handful, this year we officially increased that number tenfold. The impacts of this achievement are found in the increase of culturally competent financial counselling and literacy services being delivered in some of Australia’s most disadvantaged regions.

In July, our Townsville office celebrated its first year of operation. ICAN opened its doors in Townsville on July 1st, 2015, amidst a landscape where economic stability had significantly shifted due to increased unemployment rates and personal insolvencies. ICAN responded to the increasingly high demand for financial counselling services by providing 2.5 financial counsellors to service the region. These factors coupled with a drop in the housing market resulted in a significant level of complex casework for the financial counselling team, with one case resulting in an approximate half million-dollar windfall for the client.

In July, our Townsville office celebrated its first year of operation. ICAN opened its doors in Townsville on July 1st, 2015, amidst a landscape where economic stability had significantly shifted due to increased unemployment rates and personal insolvencies. ICAN responded to the increasingly high demand for financial counselling services by providing 2.5 financial counsellors to service the region. These factors coupled with a drop in the housing market resulted in a significant level of complex casework for the financial counselling team, with one case resulting in an approximate half million-dollar windfall for the client.

This year, we commenced our journey towards creating our social enterprise – ICAN Learn – exploring the creation of a registered training organisation (RTO) to expand our successful Yarnin’ Money and Indigenous Financial Counselling Mentorship Programs. ICAN aims to support the sector with the creation of a registered training organisation ‘social enterprise’ committed to the training and professional development of the financial wellbeing sector, including financial counselling, capability, resilience and emergency relief workers. ICAN linked up with Social Ventures Australia, the University of Queensland MBA program, Deloitte and Gilbert & Tobin to assist with the business planning process. We look forward to reporting on our progress in early 2017.

2016 was a busy year for the Yarnin’ Money team, who delivered financial literacy and capability training to seven groups across the Western Cape York region, including Rio Tinto employees, as part of their employment induction training. The team was also invited to Auckland, New Zealand, to participate in the conference “Exploring cultural perceptions of money and wealth”, hosted by the Financial Education Centre at Massey University. The Yarnin’ Money team delivered a presentation and workshop on how to use narrative approaches in delivering financial literacy education to Indigenous peoples. Our workshops were well received as a platform for the exchange of ideas and Indigenous worldviews. For Alexander Stevens from the New Zealand Commission for Financial Capability, the Workshop provided a platform for the exchange of ideas and Indigenous worldviews. “I was invited into a sacred space of learning. I was humbled by the team at ICAN who openly shared indigenous worldviews with our Australian counterparts which was a beautiful spiritual experience. To see the framework being used to enable and empower Aboriginal people to create a space where financial literacy and capability can occur is truly amazing,” he said.

ICAN’s is part of the state and national financial counselling community, which – in Queensland over the past 5 years – has struggled to meet the increasing need for financial counselling services with the loss of state funding. To give a broader perspective of what this looks like on the ground, Queensland has 34 full time equivalent financial counsellors to respond to financial hardship across the state, compared to 170 FCs in New South Wales, and 150 in Victoria. With a view to turning this situation around and supporting our community, ICAN made a significant human resource commitment to the sector, through the provision of senior representation on the Financial Counselling Association of Queensland (FCAQ) management committee: Jon O’Mally (President), Ronald Fave (Treasurer) and Unaisi Buli (Executive Member). The tireless work and lobbying of the state peak body led to the announcement of a new Financial Resilience Program by the Queensland Palaszczuk government in early 2016, that incorporated the reinstatement of funding for financial counselling.

ICAN’s is part of the state and national financial counselling community, which – in Queensland over the past 5 years – has struggled to meet the increasing need for financial counselling services with the loss of state funding. To give a broader perspective of what this looks like on the ground, Queensland has 34 full time equivalent financial counsellors to respond to financial hardship across the state, compared to 170 FCs in New South Wales, and 150 in Victoria. With a view to turning this situation around and supporting our community, ICAN made a significant human resource commitment to the sector, through the provision of senior representation on the Financial Counselling Association of Queensland (FCAQ) management committee: Jon O’Mally (President), Ronald Fave (Treasurer) and Unaisi Buli (Executive Member). The tireless work and lobbying of the state peak body led to the announcement of a new Financial Resilience Program by the Queensland Palaszczuk government in early 2016, that incorporated the reinstatement of funding for financial counselling.

Later in the year, we watched Eddie convey ICAN’s message on how to deal with direct marketing, in his television appearance on ABC’s consumer affairs program ‘The Checkout’. You can watch Eddie deliver his “If I Could Say One Thing” message to mitigate high pressure sales from door-to-door traders here.

Issues affecting Indigenous Consumers in 2016…

In March, ICAN was pleased to see the Federal Court order Chrisco Hampers Australia Ltd (Chrisco) to pay a pecuniary penalty of $200,000 for making a false or misleading representation that customers could not cancel a lay-by agreement after making their final payment, under Chrisco’s then-HeadStart Plan. ICAN brought the matter to the attention of the Australian Competition and Consumer Commission (ACCC) in 2014, after a number of Palm Island clients expressed they were experiencing financial hardship as a result of making (or attempting to make) large fortnightly payments to Chrisco, some lasting several years.

*****

In October, The Federal Court found that a Cairns-based lender, Mr Colin William Hulbert sole director of Channic Pty Ltd (Channic) and Cash Brokers Pty Ltd (Cash Brokers) breached consumer credit protection laws. Mr Hulbert provided loans at 48% interest through Channic to vulnerable Indigenous consumers for the purchase of second hand cars from Super Cheap Car Sales, a company that he also owned. The high interest loans were arranged through Mr. Hulbert’s brokerage company Cash Brokers for a brokerage fee of either $550 or $990, which were also financed under the loans.

Channic and Cash Brokers had breached responsible lending laws under the National Consumer Credit Protection Act 2009 (National Credit Act) and engaged in unconscionable conduct, where loan contracts were found to be unjust transactions. The Court also held Mr Hulbert personally liable, stating that: Cash Brokers and Channic were no more than wafer thin transparent membranes between the consumer and Mr Hulbert. Nathan Boyle of ASIC’s Indigenous Outreach Program noted that what makes this case unique is that “witnesses from the Aboriginal community of Yarrabah provided direct statements to the court, greatly assisting with the Federal Courts findings. The witnesses should really be congratulated for making a stand. The relationships and trust that we built in Yarrabah throughout the course of the proceedings is something that we’re keen to replicate in future enforcement activities.”

ICAN brought the conduct to the Australian Securities and Investments Commission’s attention, as our financial counsellors witnessed many people suffering financial hardship as a result of loans they had taken out with Channic. ICAN has assisted ASIC in gathering evidence leading up to the case, over many years during this long-standing matter.

*****

ABCF payments via Centrepay to cease

Following on from the May 22nd, 2015 announcement by Minister for Human Services Senator the Hon Marise Payne, that funeral insurances would be excluded from the Centrepay system, the beginning of 2016 marked the half-way point for the 12 month transition period for existing contracts to be phased out of the system (July 1st, 2015 – July 1st, 2016). ICAN was pleased to hear that funeral insurances were to be excluded from the welfare recipient payment system, having joined the consumer movement in its steadfast advocacy for changes to the Centrepay system.

Over 2016, we watched the story continue to unfold. In May 2016, the Aboriginal Community Benefit appealed the decision to exclude funeral insurance from the Centrepay system. On July 5th, 2016, it was reported that the appeal was upheld, with the Federal Court highlighting ‘the inadequacy of legislation supporting Centrepay and welfare payments in protecting vulnerable recipients’*. As consumer advocates, we worried for how this decision would continue to impact upon Indigenous peoples, where many are already struggling to meet basic living expenses on limited incomes.

By mid-November, we were relieved to hear the news that ‘an Appeal Court decision was made to allow the Commonwealth to ban’ the funeral insurance provider from being able to access the Centrepay system**. We saw the decision arising from the Centrelink appeal as a win for increased consumer protection for Indigenous centrelink recipients.

Centrelink will support affected customers in their transition to new arrangements. Any remaining Centrepay deductions will cease from February 17, 2017.

******

Thank you for following us on our journey through 2016, and see you in the New Year!

As we celebrate our tenth year of incorporation, Queensland moves into a new era of financial inclusion. We are pleased that one of our guiding philosophies; ‘we can achieve greater social impact in our communities by building strong working relationships with government, industry and community sectors’, is being embraced in Queensland. Looking ahead in 2017 this guiding philosophy will continue to direct our work and shared success.

As we celebrate our tenth year of incorporation, Queensland moves into a new era of financial inclusion. We are pleased that one of our guiding philosophies; ‘we can achieve greater social impact in our communities by building strong working relationships with government, industry and community sectors’, is being embraced in Queensland. Looking ahead in 2017 this guiding philosophy will continue to direct our work and shared success.